Introducing Bettr and Embedded Lending: Empower MSMEs and Turn Financing into Your Advantage

Why Do MSMEs Need New Funding Sources?

Micro, Small, and Medium Enterprises (MSMEs) might be seen as minor players, but in reality, they are the “backbone of the Thai economy.”

According to data from Thailand's Office of Small and Medium Enterprises Promotion (OSMEP), there are over 3.2 million MSMEs in the country, generating economic value exceeding 6.3 trillion baht, or 35% of the nation's GDP. Despite being essential drivers of the economy, accessing financing continues to be a significant challenge for this group.

Many businesses possess growth potential but are forced to slow down expansion due to insufficient working capital. While using personal funds might work in the short term, when it's time to increase inventory, accept large orders, or scale operations, the lack of accessible credit becomes a significant obstacle. This problem doesn't just affect MSMEs; it creates a ripple effect impacting larger corporations that rely on these smaller suppliers.

Although traditional loans offer one solution, they often come with stringent conditions, extensive documentation requirements, and the need for collateral. Furthermore, many small businesses lack the comprehensive financial data required for conventional loan applications, effectively excluding them from the formal financial system. Consequently, numerous businesses turn to informal channels that charge exorbitant interest rates – an unsustainable and ultimately inadequate solution.

This is precisely where Bettr and Embedded Lending step in to change the game.

Bettr (pronounced ‘Better’) is a digital lending business operating under Ant International, known in Thailand for familiar names like Alipay+, 2C2P, and WorldFirst.

Bettr's vision is to simplify financing for every business through Embedded Finance – financial services integrated seamlessly into other platforms. Bettr is leveraging this concept, specifically through Embedded Lending, to unlock new opportunities for businesses.

Bettr Turns Businesses into Funding Sources, Unlocking Opportunities with Embedded Lending

Let's start with: What is Embedded Lending ?

Embedded Lending is a component of Embedded Finance focused on providing credit through various digital platforms, eliminating the need for direct interaction with a bank. Common examples include credit lines offered within shopping apps like Lazada, or business loans provided to online merchants via e-commerce platforms.

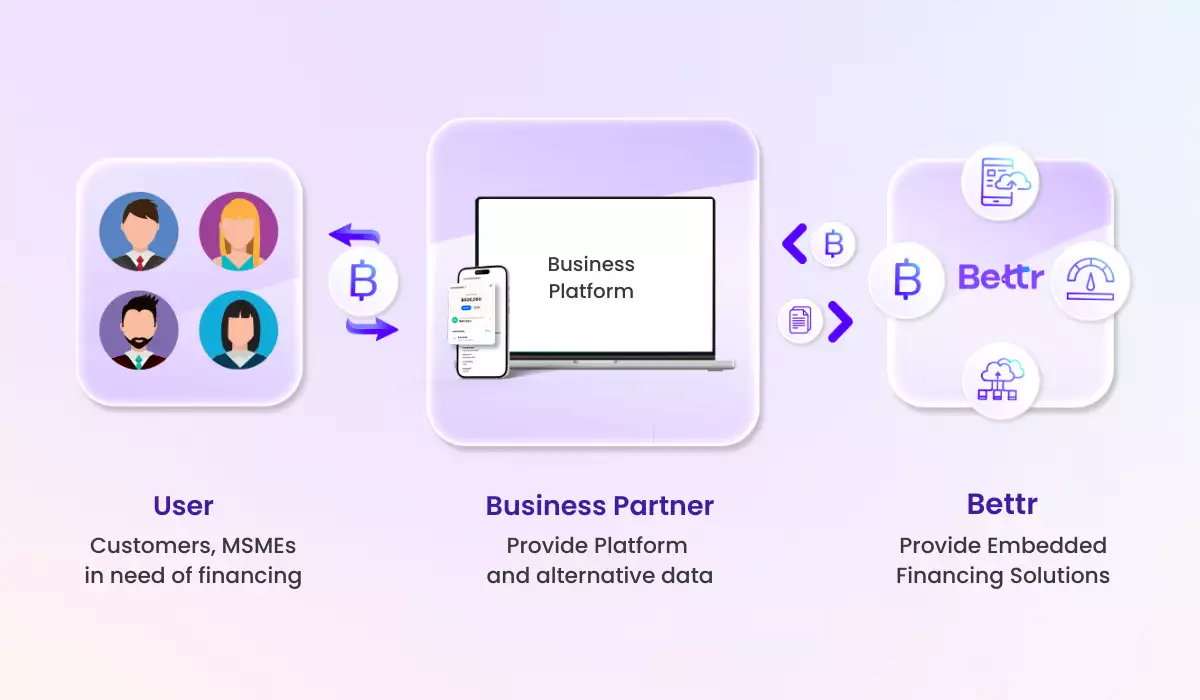

To deliver Embedded Lending, Bettr collaborates with business partners – such as e-commerce platforms, logistics providers, supply chain companies, or retail groups – who already possess a customer base and alternative data.

- Bettr's business partners embed the lending system into their own platforms.

- Their customers, partners, or suppliers needing capital can apply for loans directly through that platform they’re using.

- With user’s consent, Bettr utilizes alternative data shared by the partner to help assess creditworthiness and determine loan limits.

- Bettr analyzes the data and approves the loan; the customer can then immediately access the funds through a fully integrated digital system.

Bettr's system leverages transactional data generated within the partner's platform as alternative data, enhancing credit analysis accuracy. This gives good businesses previously denied loans due to lack of collateral or traditional credit history a better chance of approval.

Making financing more accessible through alternative data

For Bettr, utilizing Alternative Data is central to its lending approach. It opens doors for small businesses that might lack a formal credit history within the traditional banking system, making it easier for them to access much-needed capital.

Instead of relying solely on credit reports, Bettr uses real-world insights generated within the partner's ecosystem to evaluate loan applicants. This data can include: trading behavior and patterns, payment history and information, order and inventory data, digital platform usage behavior, and finally business network information, and more.

Upon application submission, Bettr employs its Credit Technology, using this alternative data to translate behavioral insights into metrics that accurately assess risk. This enables good businesses without a conventional banking credit history to successfully apply for loans and fuel their growth.

Want to Offer Financial Solutions to Your Customers Without Building Your Own System?

Businesses looking to add financial services or support their own customer base can partner with Bettr. This collaboration allows partners to offer their clients and associates seamless access to financial services, including loans or repayment options beyond just cash or credit cards, tailored to their specific business needs. This offers several key advantages:

- No Need to Build Your Own Lending System: Reducing Costs and Complexity: Developing an in-house lending system demands significant investment in infrastructure, technology, and specialized credit management personnel. This is an unnecessary burden for businesses wanting to offer more financing flexibility. Bettr acts as a lending solution provider. Businesses can directly embed Bettr's credit services into their existing platforms or sales channels without developing new systems to get access to an easy lending service for their ecosystem.

- Enhance Competitiveness by Facilitating Customer Funding: Partners can directly help their customers or associates access suitable financing options, such as working capital loans, Business Buy Now Pay Later (BNPL), and comprehensive Supply Chain Financing (covering both Invoice and Purchase Order Financing). This provides customers with flexible financing choices, stimulates sales, and helps businesses expand their customer base more rapidly.

- User-Friendly and Ready to Connect: Bettr's solution is designed for easy integration with partner systems, whether they operate via a dedicated platform, application, or other operational models. This allows businesses to quickly launch financial services without lengthy in-house technology development. Customers can apply, get approved, and manage repayments directly through Bettr's system, similar to integrating a CRM.

Ultimately, the end-users – the partners' customers or suppliers – gain easier access to funding without navigating complex traditional banking processes. They can apply for and receive loan approval quickly through an entirely digital system, even without collateral or a traditional high credit score, saving significant time and effort.

As you can see, it's a mutually beneficial arrangement. Business partners gain solutions to monetize and retain customers. End-users, like MSMEs, get simpler, safer access to credit. Bettr, in turn, expands its reach through a robust network. It’s a system that fosters balance and enables all parties to grow together sustainably.

A Conversation with Mr. Tee Chayakul on Accessible and Sustainable Finance

Bettr wants to help businesses access funding more effectively

Mr. Chayakul explained to Techsauce that Thailand is home to over 3.2 million MSMEs, yet more than half of them still struggle to access financing, often resorting to unsustainable methods out of necessity.

This isn't a distant problem; it's a reality faced even by entrepreneurs generating millions of baht annually, whose growth is stifled by financial roadblocks. Mr. Chayakul shared an example: a business owner supplying a major convenience store chain. He ships large orders monthly, with payment due in 45 days, but must pay his own suppliers within 15 days.

This cash flow gap is significant, forcing him to find substantial working capital while awaiting payment. When seeking a loan from traditional institutions, he was told he needed a 3 million baht deposit to secure a 6 million baht credit facility– a condition that defeats the purpose of borrowing. This is why Bettr exists: to make finance accessible and sustainable for all businesses.

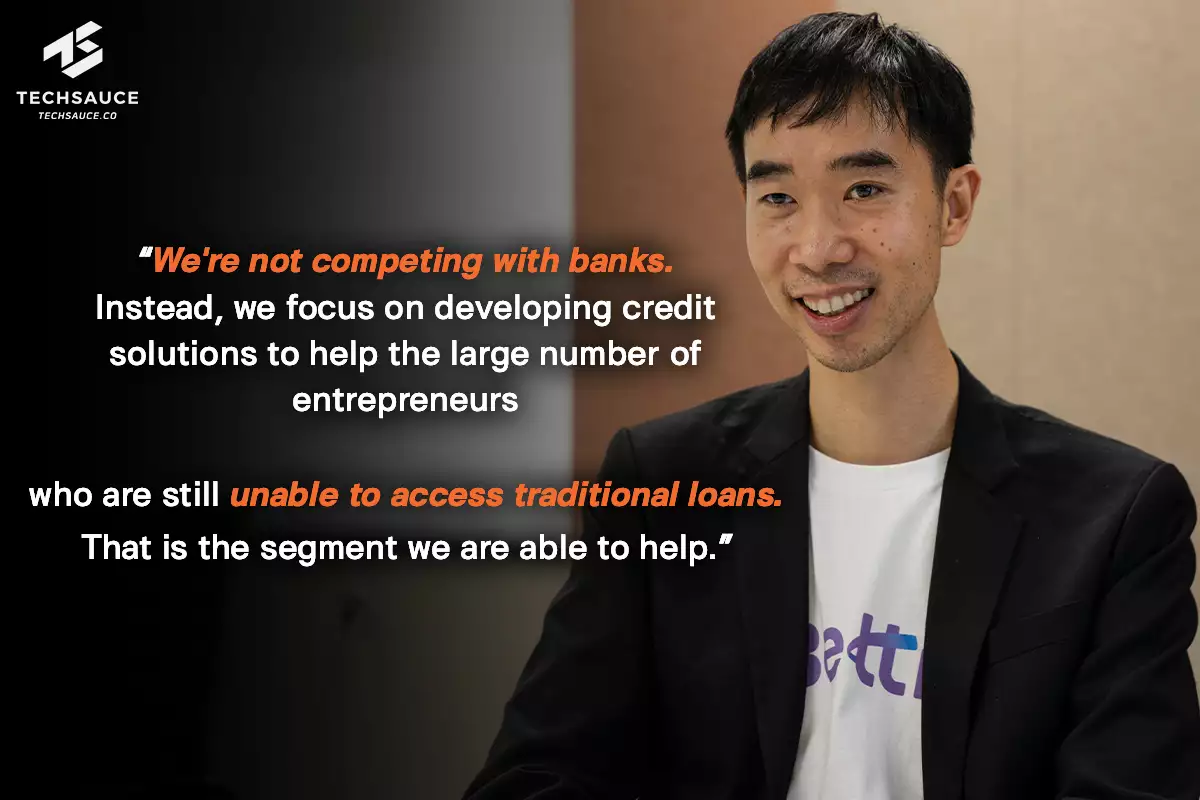

Not Competing with Financial Institutions, But Filling the Gap

Mr. Chayakul spoke frankly with Techsauce, stating that Bettr has never viewed itself as a competitor to banks. He explained that this is because if someone can get a loan from a bank, they should absolutely go there first. However, the reality is that a large number of businesses still cannot access traditional lending. This isn't always due to an inability to repay, but rather because the conventional lending system isn't aligned with their business models. This is precisely the segment Bettr can assist, filling a currently unmet need.

This philosophy led Bettr to design its Embedded Lending service as a forward-looking credit institution, not merely backward-looking. The core issue with traditional lending models is their reliance on the “past” to determine the future, using metrics like historical financial statements, 3-year average income, bank account records, and so on.

Bettr, however, believes that a business's true potential lies not just within its financial statements, but also in its actual operational behavior. This is why Bettr chooses to utilize Alternative Data – information that reflects the business's past, present, and future – in its credit assessments.

Bettr's Future Path: Customer First & Inclusive Finance

If we view finance as the lifeblood of MSMEs, then we must do more than simply provide ‘loans’ but we need to build an ecosystem that enables these businesses to genuinely thrive. This is why Mr. Tee Chayakul envisions Bettr's future extending beyond merely being a lending platform. He sees it evolving into a system of finance accessible to everyone – Inclusive Finance – grounded in a Customer First philosophy.

Because ultimately, “sustainable financial inclusions” means understanding the customer; it's not just providing funds, but providing solutions that truly work.

If you are interested in partnering with Bettr to offer lending services and take part in driving inclusive and sustainable financial solutions, you can contact Bettr at: https://www.bettrfinancing.com/th-en/

This article is an Advertorial

ลงทะเบียนเข้าสู่ระบบ เพื่ออ่านบทความฟรีไม่จำกัด